autoscout24

Dealer Area Redesign; Boosting revenue-driving engagement by 150%

my role

E2E Ownership - Dealers Platform

setup

Centralised Team / Kanban

Time frame

Q4 2024 - Q2 2025

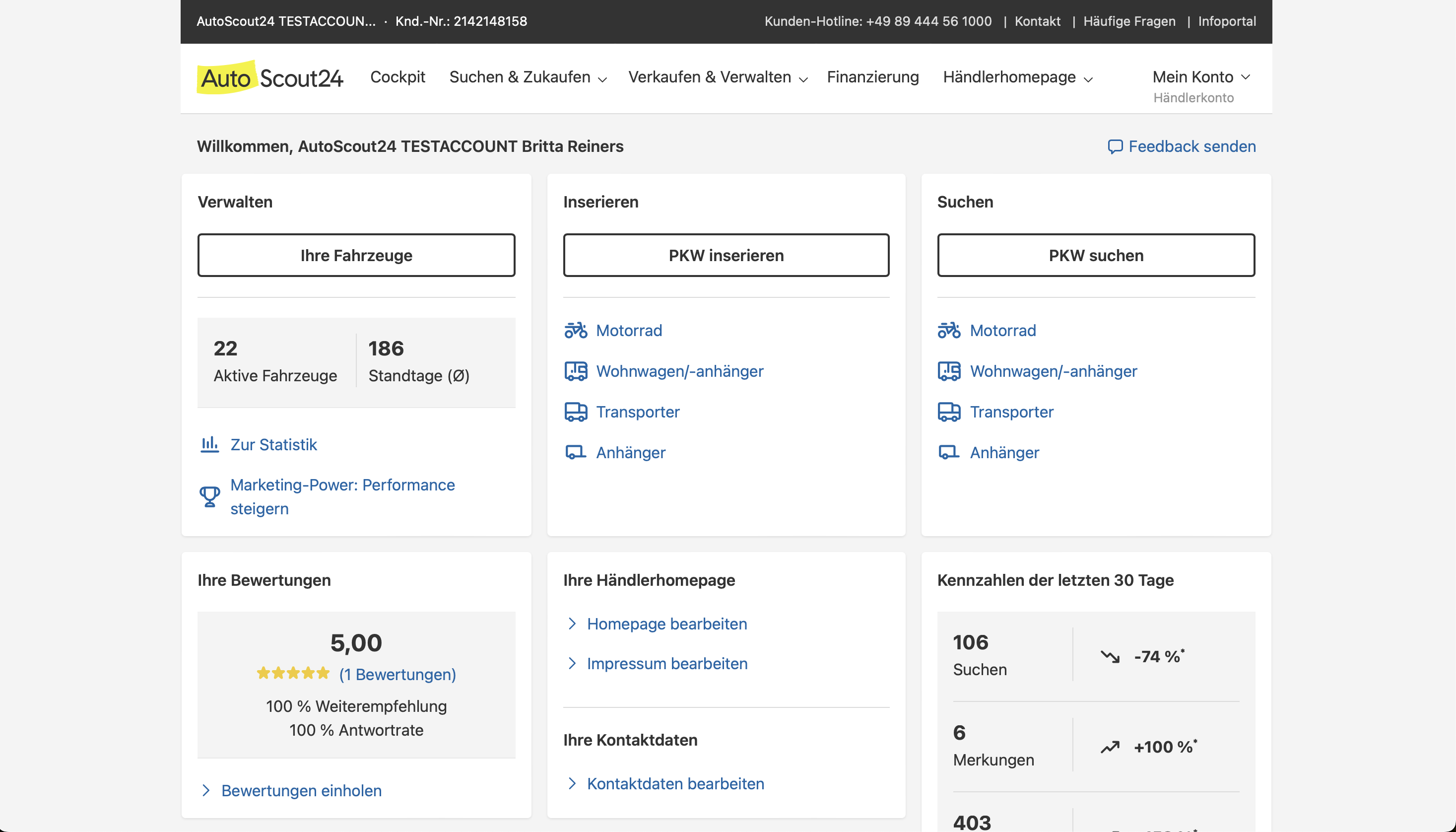

AutoScout24 is Europe’s leading automotive marketplace.

Its Dealer Area is responsible for 95% of org revenue. It is where car dealers execute most of their digital daily tasks.

Problem

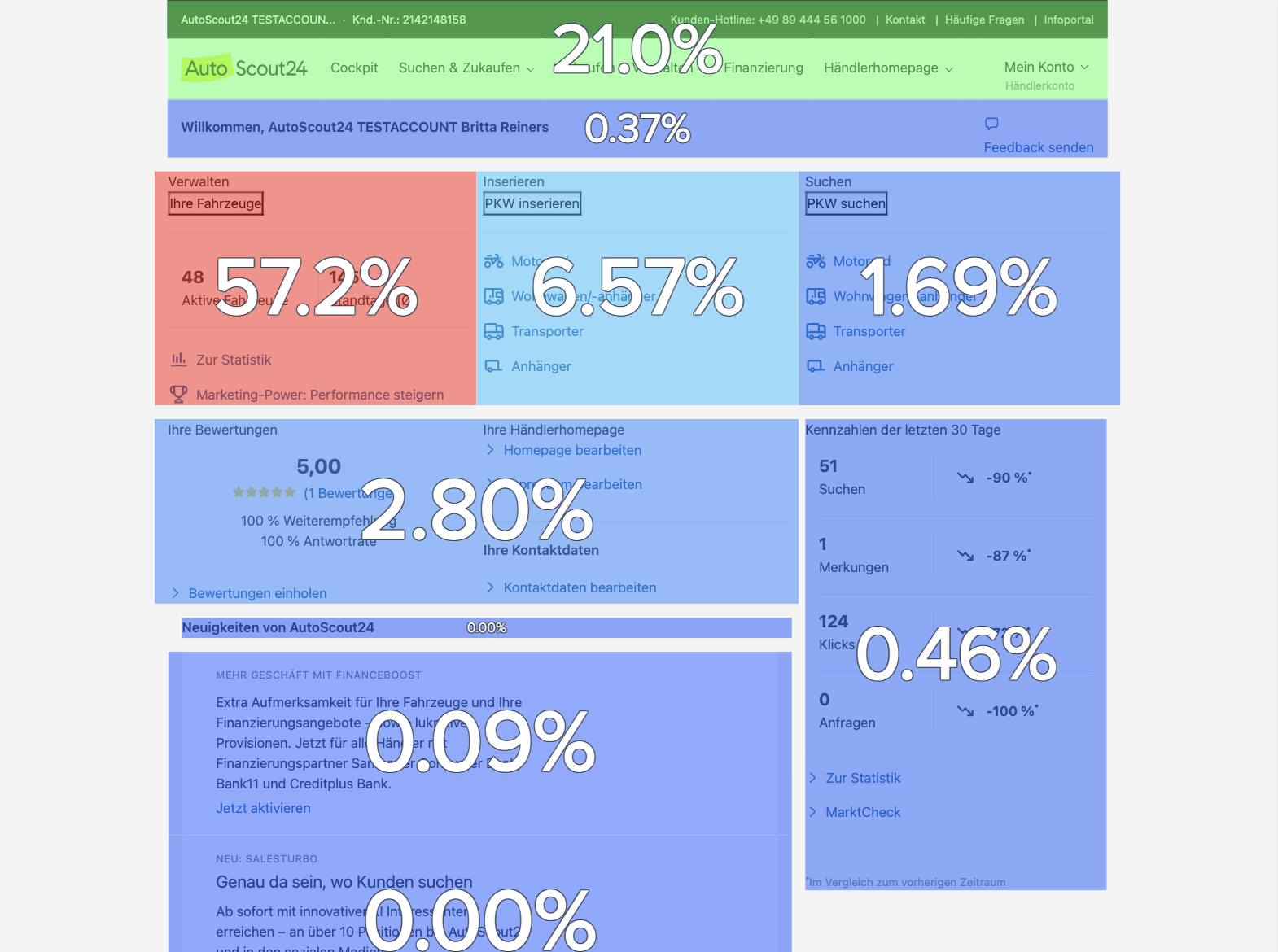

The dealer platform fails to deliver clear value to inventory and sales decision-makers, as fragmented workflows, scattered data, and unclear impact limit action and engagement across accounts of all sizes.

70%

Struggle sourcing vehicles due to lack of effective tools and reliable data sources

60%

Go through the same daily basic actions, without exploring impactful features

2.5%

Smart features engagement - 60% lower ROI than expected

Objective

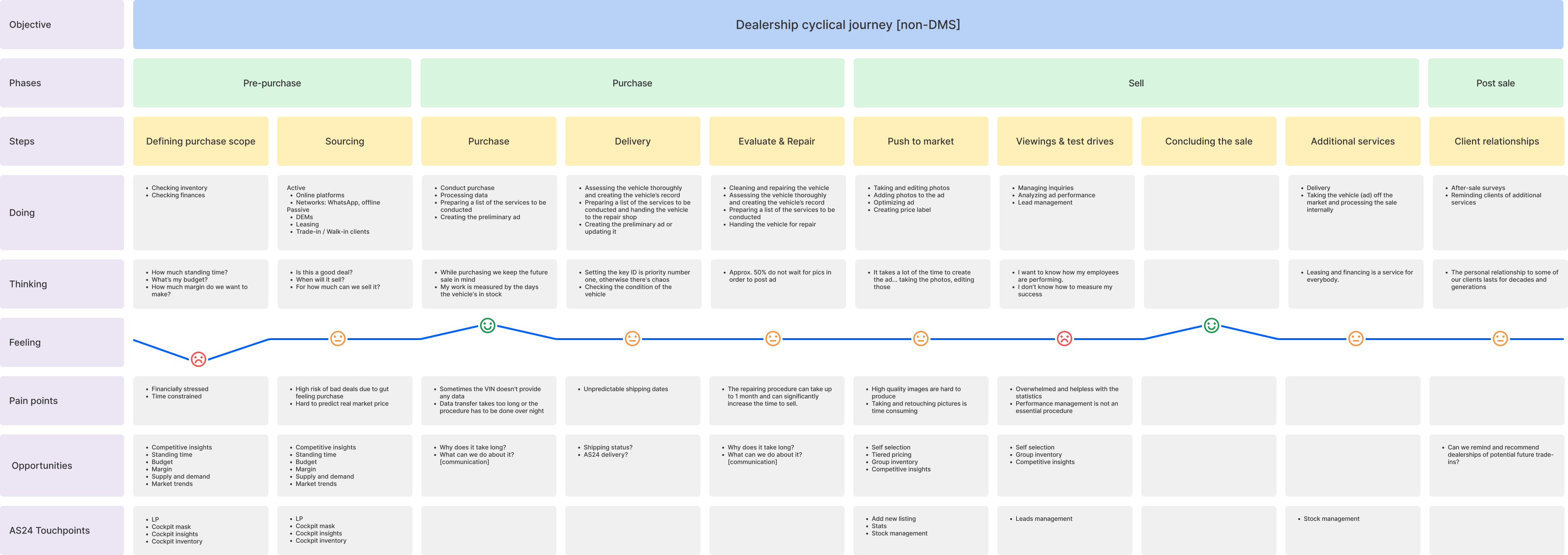

Re-engage DMS-using accounts, by giving them valuable, strategic insights, while empowering smaller dealers with actionable insights to compete effectively. Increase overall engagement across both groups.

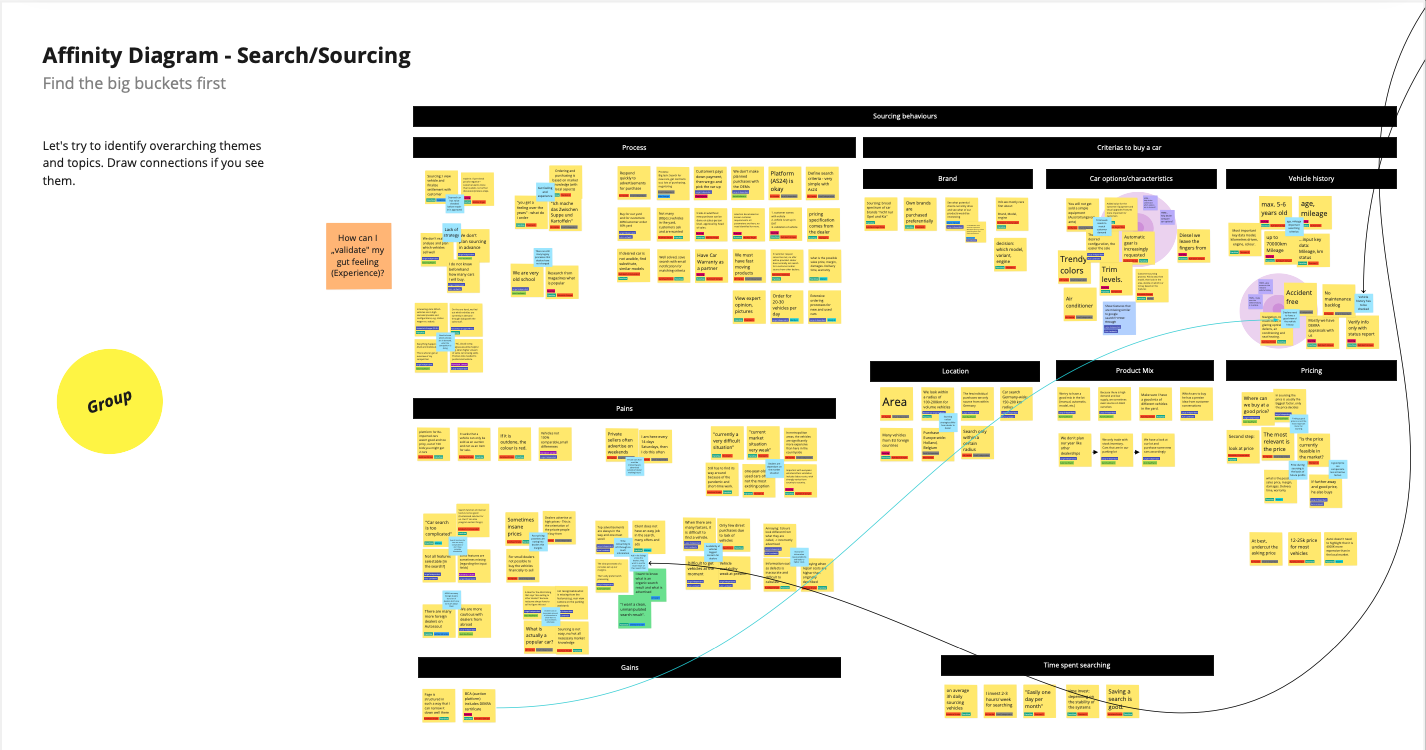

Assessing the Problem

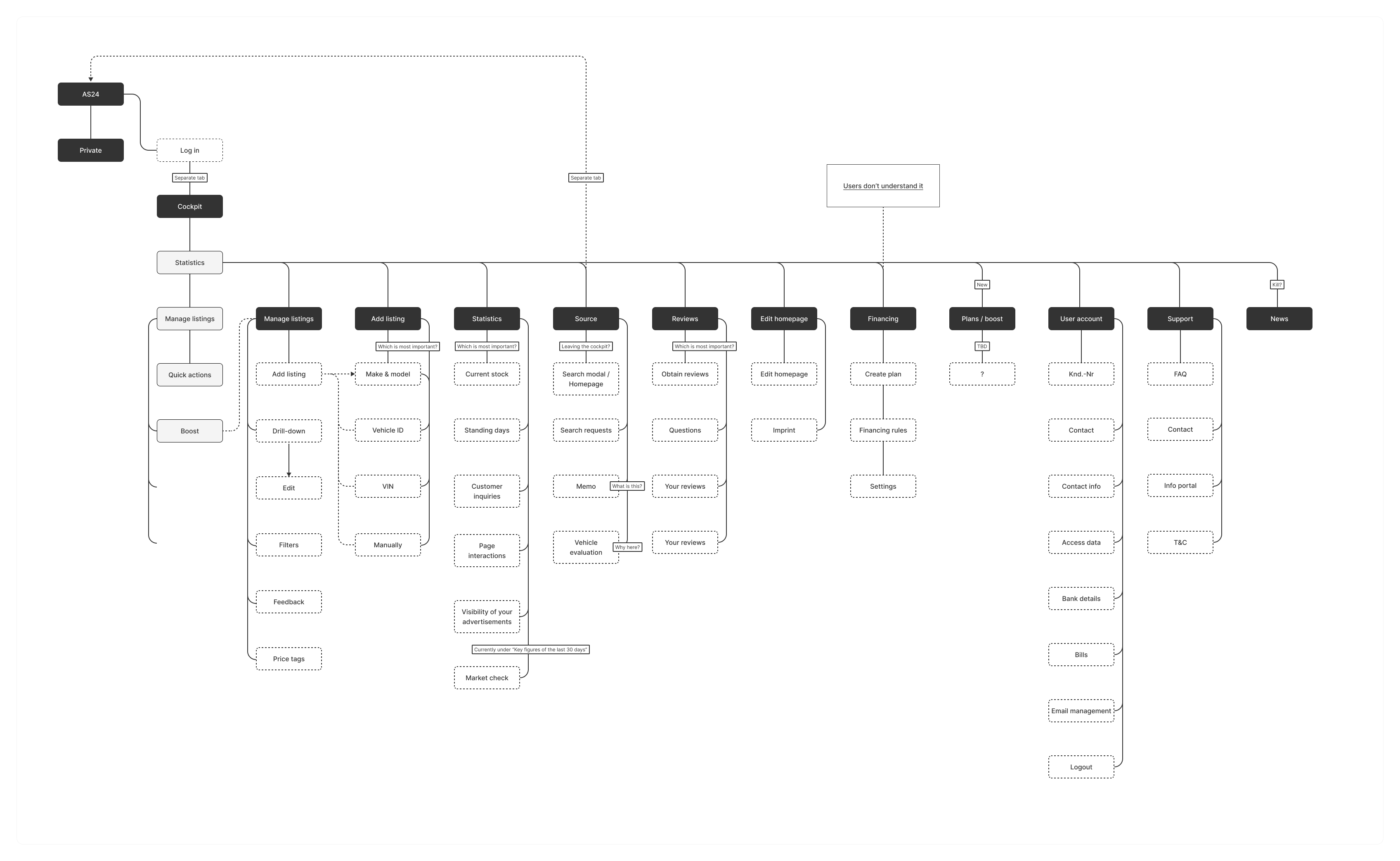

We mapped out the user journeys of 8 different markets, with 9 possible users groups, each having up to 5 roles

Objective & Approach

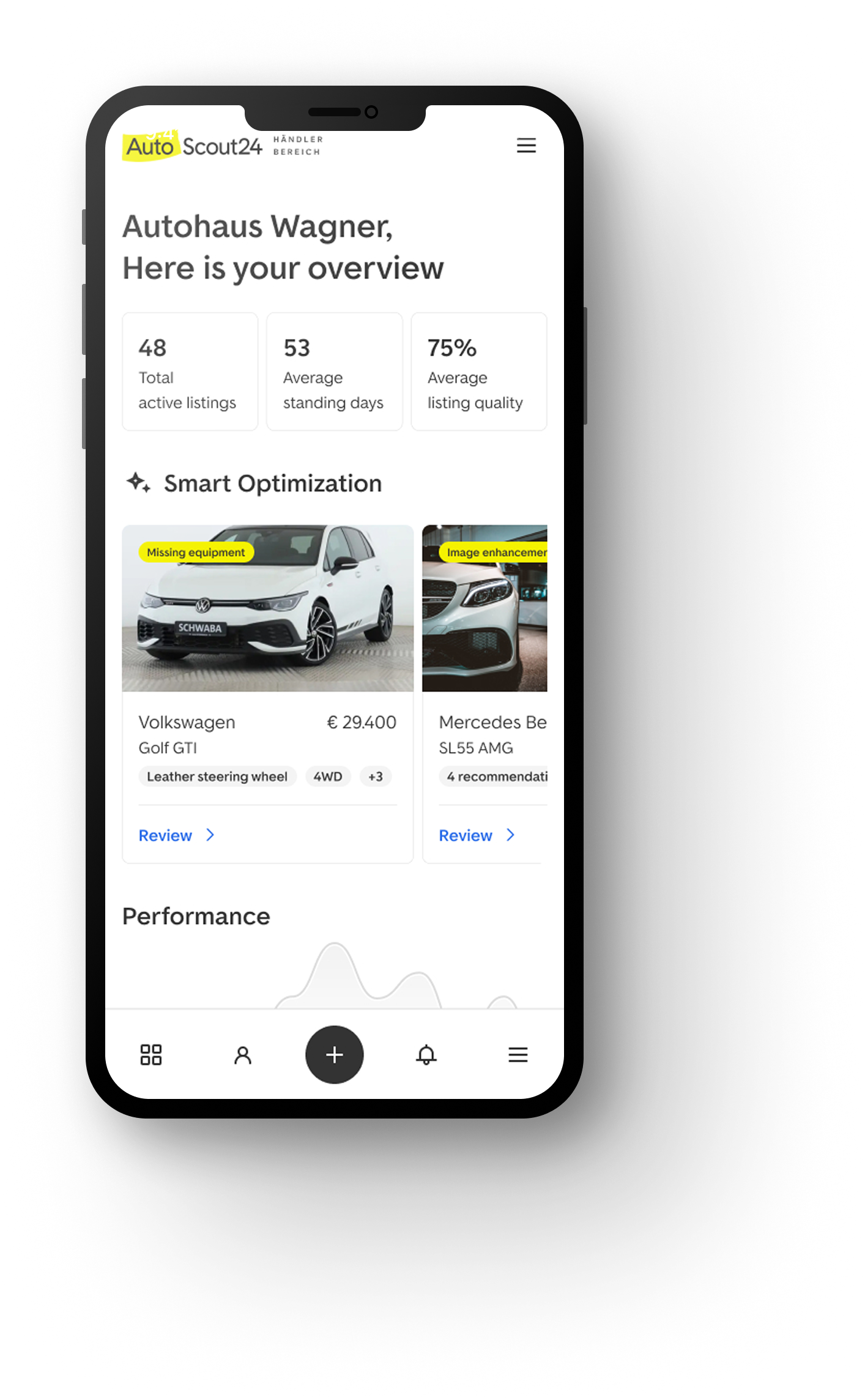

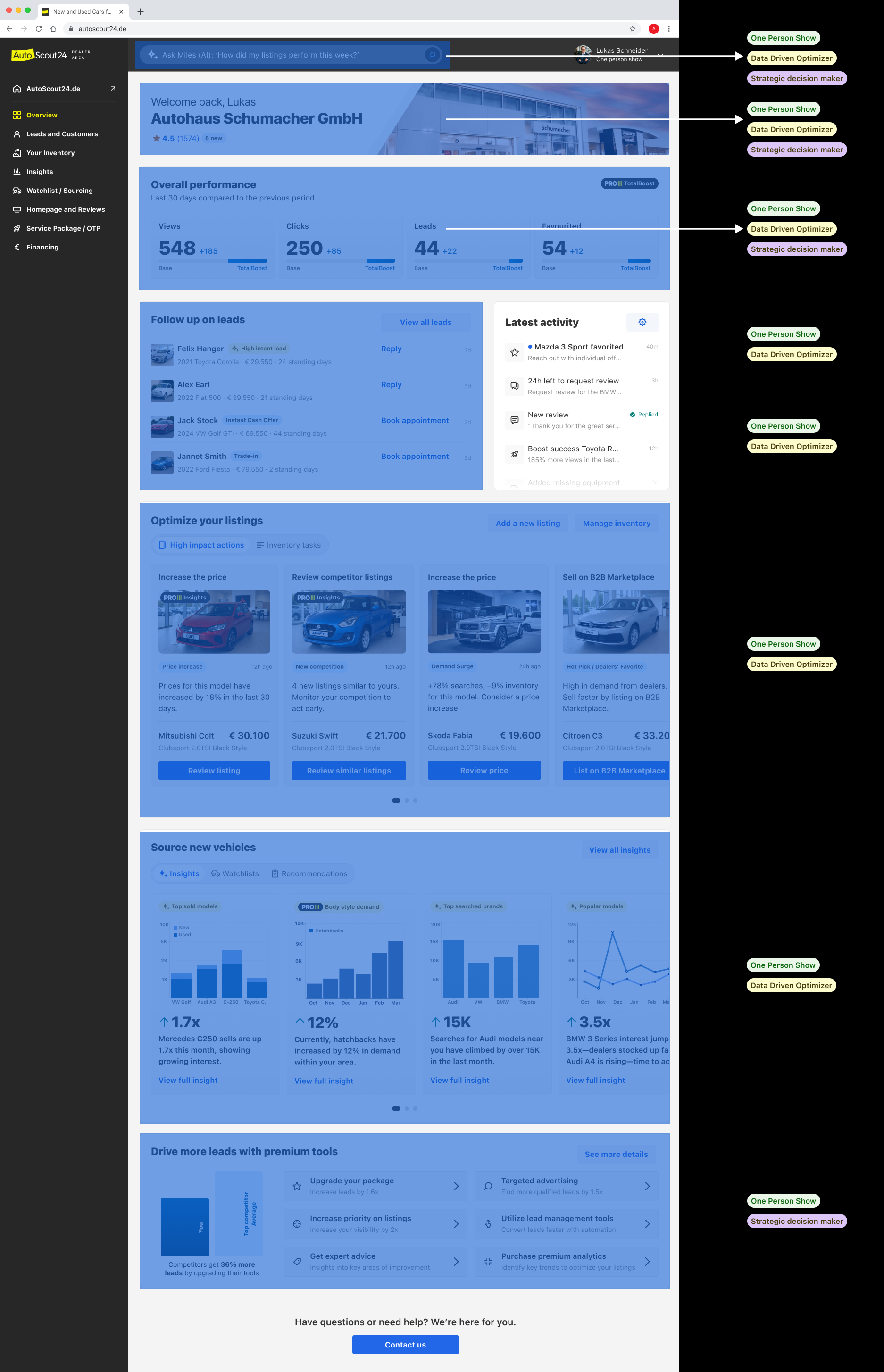

Instead of forcing one UX on all dealers, we design around the idea of progressive relevance. I defined the core personas, then optimised taxonomy for the most universally relevant insights appear first, with deeper layers available when needed.

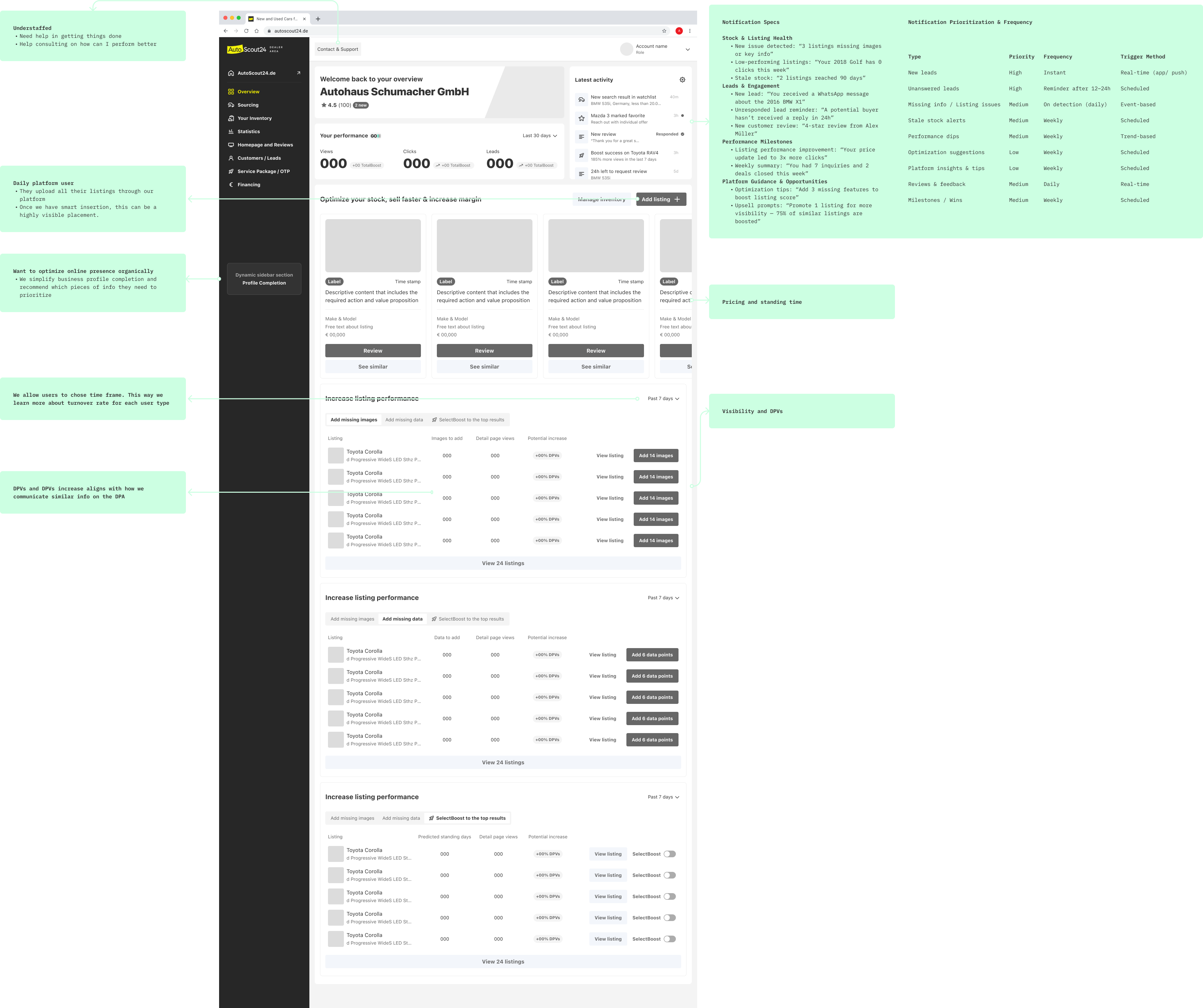

Cross-Functional Ideation & Testing

I collaborated with functions to understand business needs, prios and constraints. Testing ran with 9 groups of 5 testers from multiple markets.

Driving AI Innovation

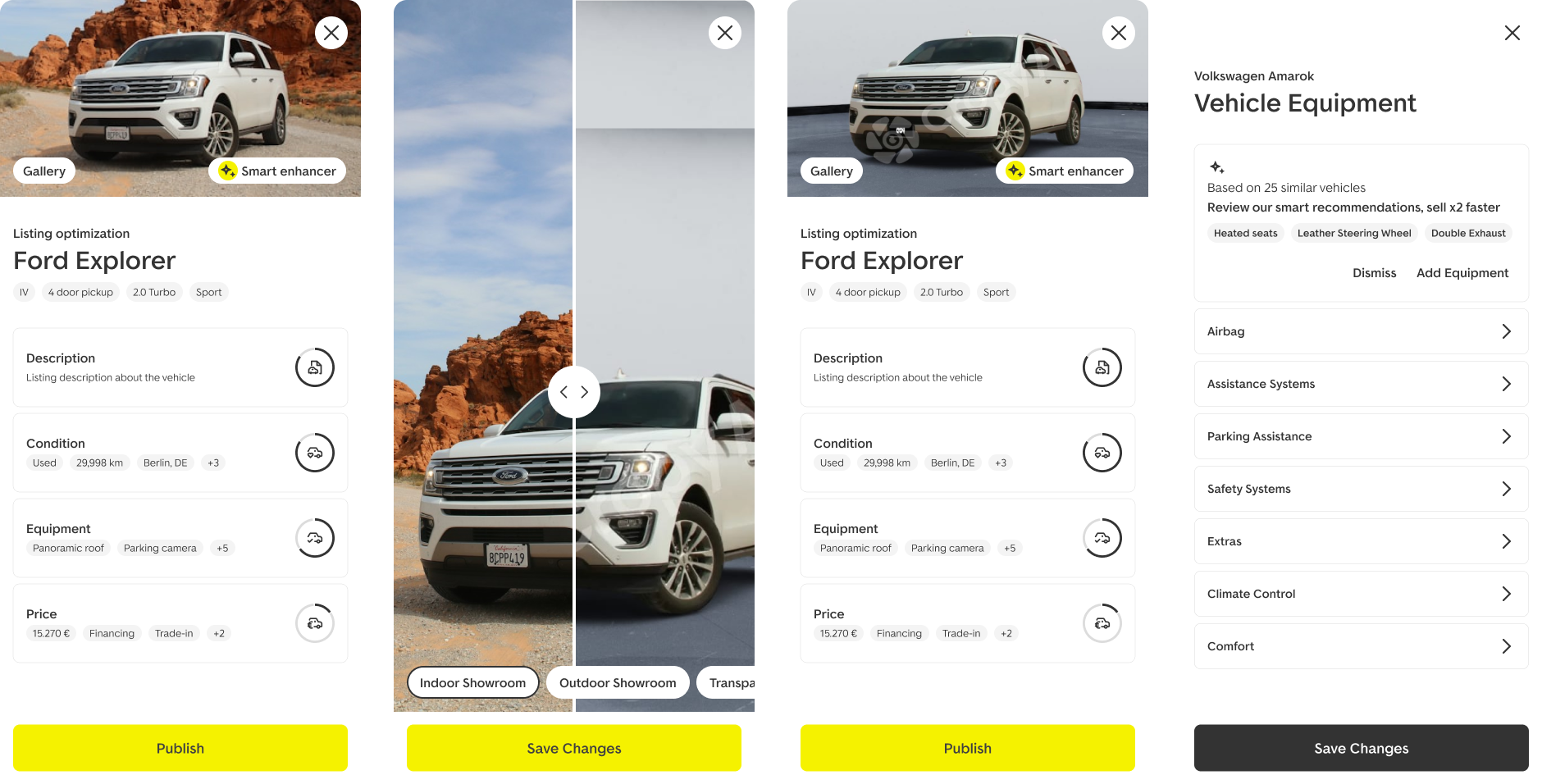

With data science & engineering, I mapped AS24’s tech strengths, from listing data models to content generation & identified where AI adds value. This made a clear business case: AI could cut workload, boost listing quality, & strengthen AS24’s position.

Outcome

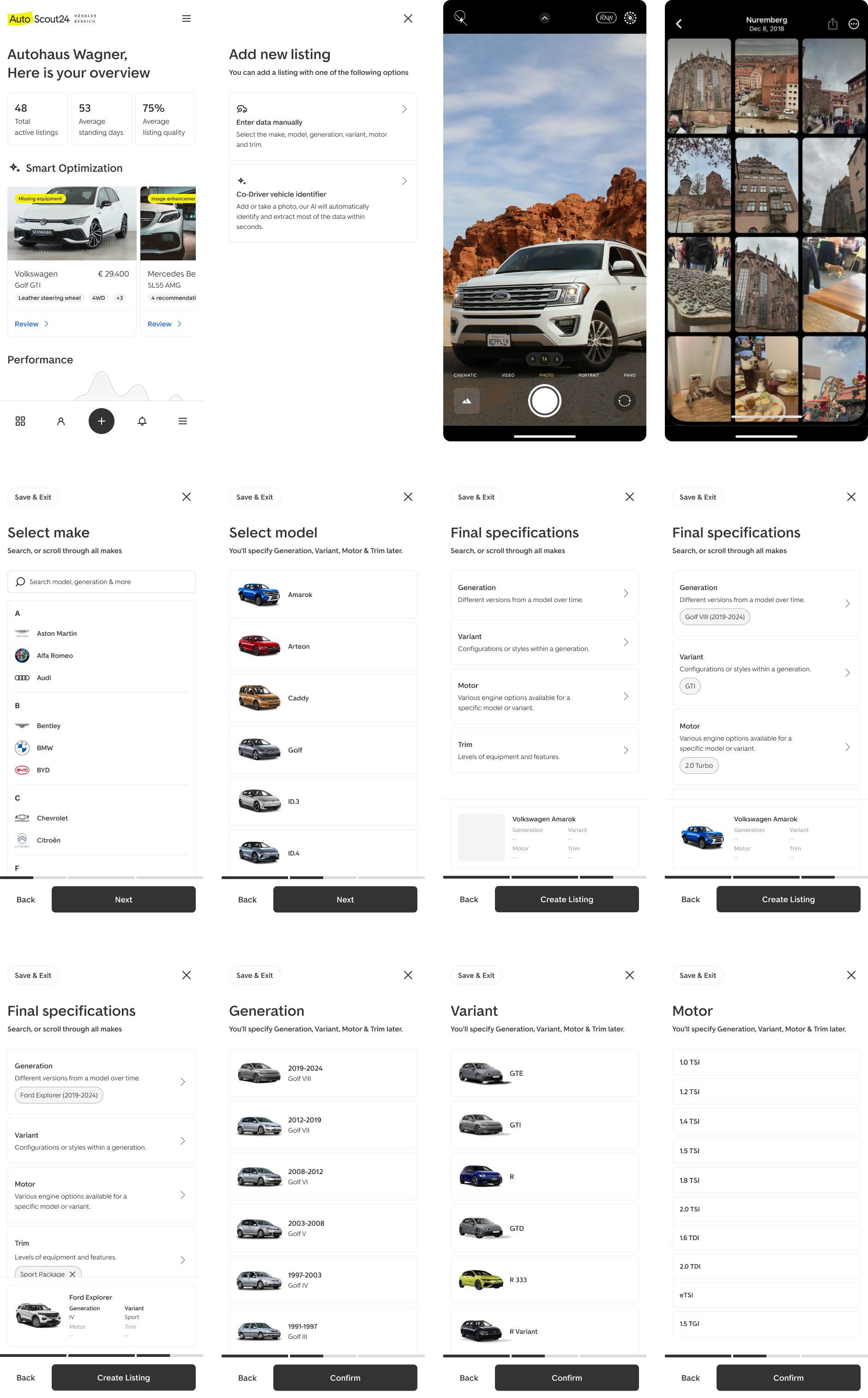

Enabled the first AI-assisted listing optimization prototype, reducing manual listing time by over 30% in early tests.

A special focus was put on micto-interactions using Jitter and Lottie

A special focus was put on micto-interactions using Jitter and Lottie

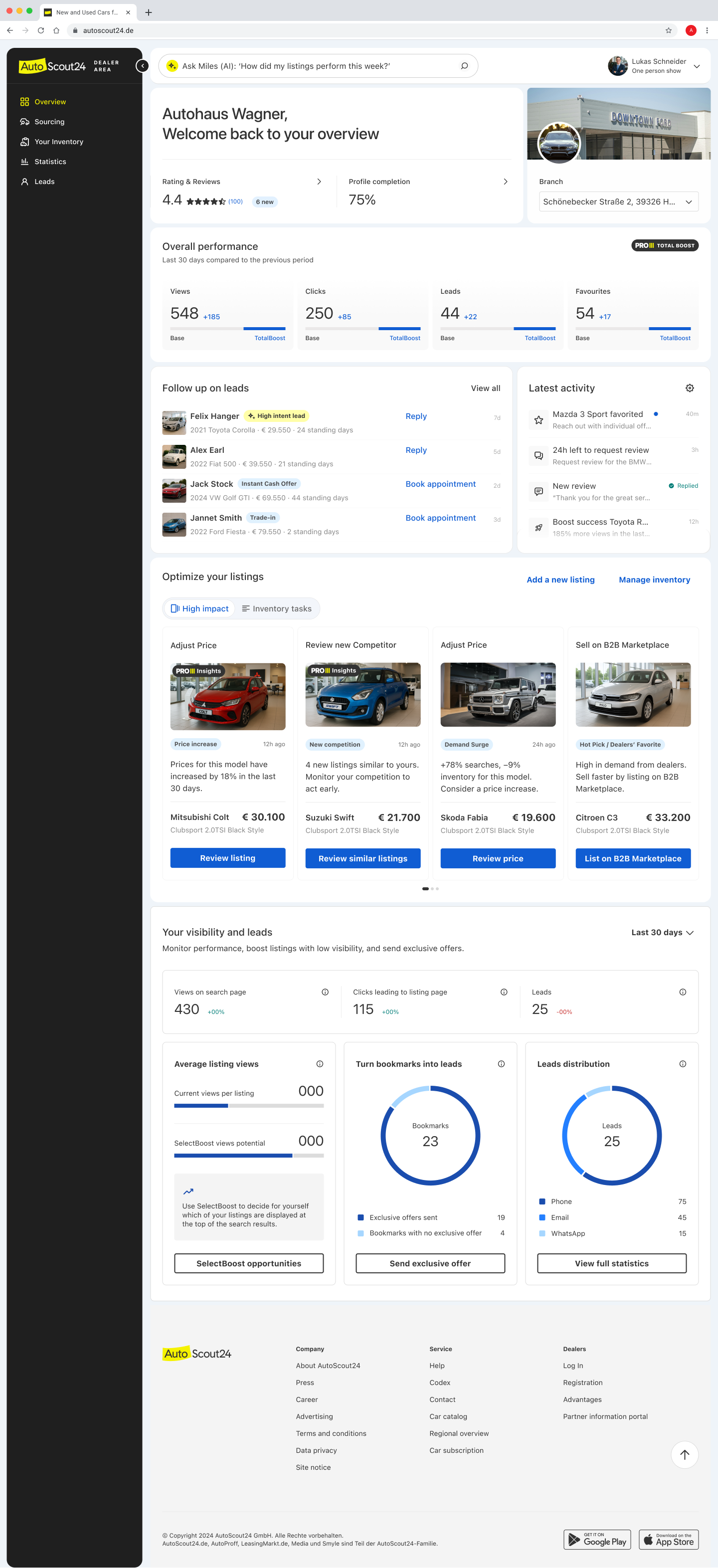

Release

We launched three UIs in phases, to address the main problems. With product & engineering we defined scope, dependencies, and rollout, ensuring quality while minimizing risk.

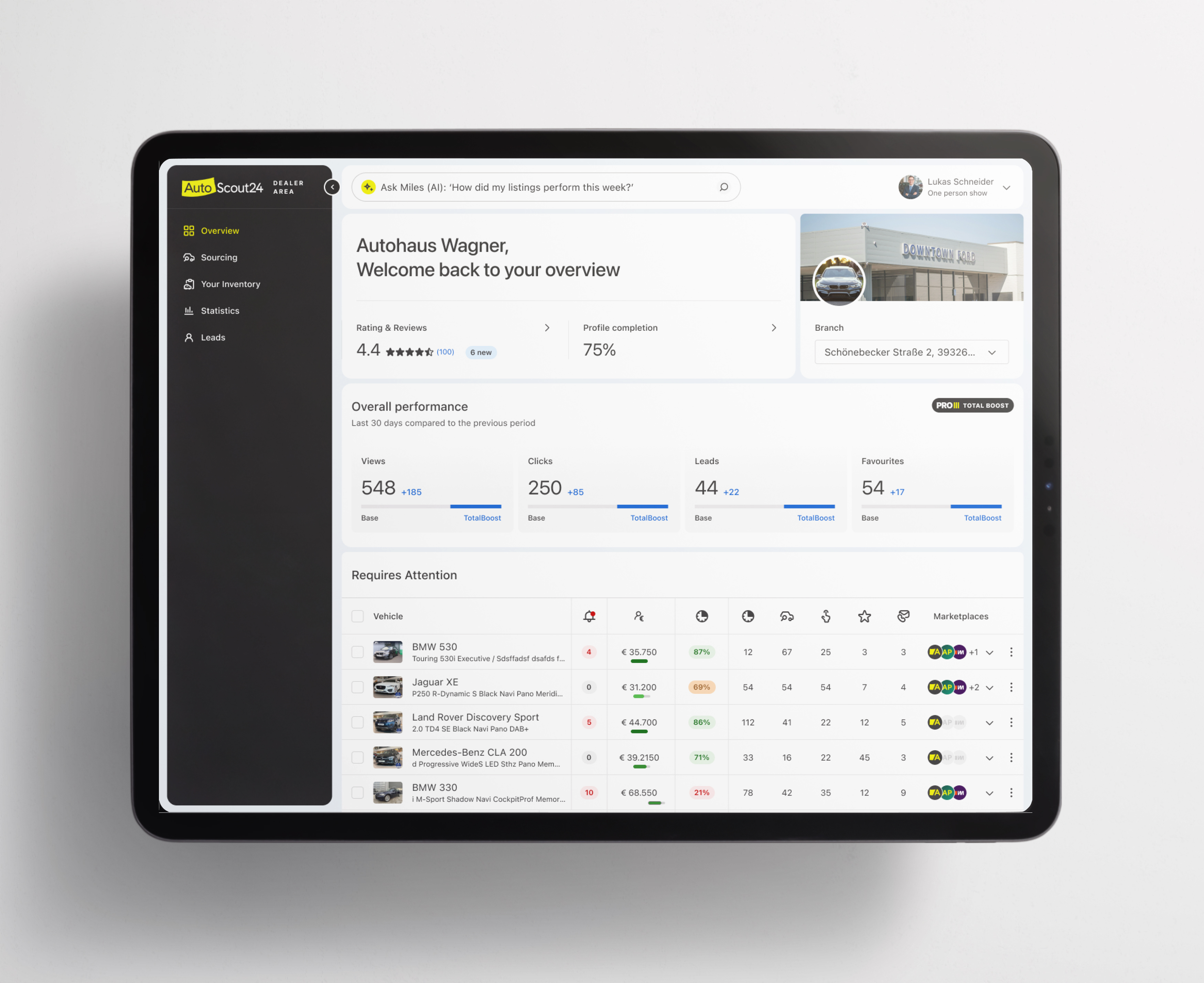

Desktop - Multi Branch, Sales User

Overview tagged per persona

Mobile - Smart Insertion and Optimisation.

Integrating AI in My Workflow

To move fast and explore broadly, GPT became a thinking partner for concept framing, UX copy, and user flow simulation, while Lovable helped me turn prompts into interactive prototypes within hours.

Outcome

Accelerated design iteration cycles by ~40% and helped define AI-driven UX guidelines later adopted by the wider team.